Where AI Meets Trade Finance Excellence

AI Powered LC & Trade Document Verification Solution

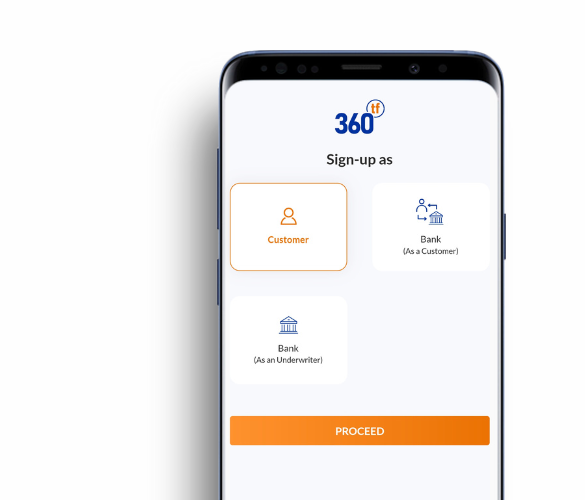

Connecting Banks and corporates Digitally, Transforming International Trade Finance.

Our Offerings

Global trade document scrutiny with speed, accuracy, and compliance, powered by AI and trade finance expertise.

AI-Powered LC & Document Scrutiny

Early Discrepancy Detection

Validates Against UCP, ISBP, MT700

Cross-Document Validation

Faster Turnaround Time

Lower Discrepancy & Amendment Costs

How Does 360tf VeriFi Works?

What clients are saying about us...

FAQs

What exactly is 360tf VeriFi?

360tf VeriFi is an AI-powered platform that automates and validates your trade finance documents especially Letters of Credit (LCs) and related paperwork — in under few hours. It helps you catch discrepancies early, avoid delays, and get your payments faster.

We already have internal teams for document checking. Why do we need this?

That’s a great question. Internal teams are important — but even the best teams make manual errors, especially under pressure. Our platform doesn’t replace your team — it empowers them with 450,000+ rule checks, real-time LC scrutiny, and discrepancy detection. It reduces turnaround time from days to hours, freeing your team for more strategic work.

We don’t deal with high volumes. Is this still useful for us?

How do you handle complex LC clauses or region-specific wordings?

Can your platform detect fraud or duplicate documents?

What kind of ROI can we expect?